The Role of Hyperautomation in Modernising Financial Services

Few industries juggle complexity like financial services. Every transaction, loan approval, and customer query happens in a space demanding precision, speed, and trust. But traditional systems and manual processes often struggle to keep up with modern demands. Today we have hyperautomation, the transformative force that’s helping financial institutions reimagine their operations, streamline workflows, and deliver faster, smarter services.

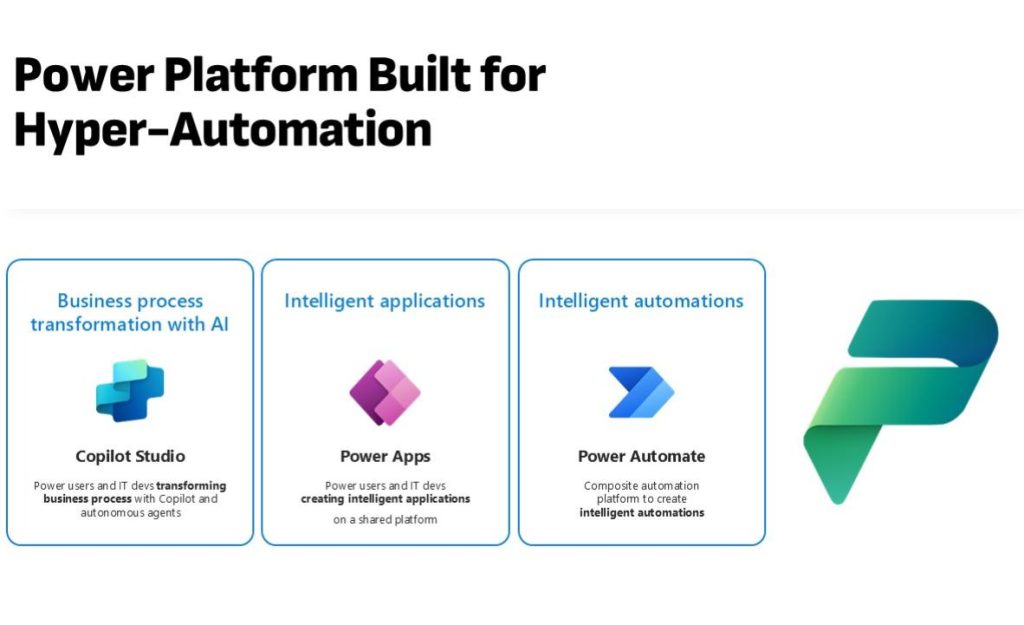

With artificial intelligence (AI) and tools like Microsoft’s Power Automate, financial services are not just keeping up, they’re leaping ahead. By automating repetitive tasks, enhancing decision-making, and improving operational efficiency, hyperautomation is setting a new standard for innovation in finance.

Key Takeaways:

- Unlock Efficiency: Automation frees up teams to focus on higher-value initiatives.

- Enhance Accuracy: AI-driven processes minimise errors and improve data integrity.

- Boost Agility: Rapid workflows help institutions respond quickly to market changes.

- Ensure Compliance: Automated processes adapt to complex regulatory requirements.

Understanding Hyperautomation in Financial Services

Hyperautomation blends technologies like AI, machine learning, robotic process automation (RPA), and analytics to revolutionise how work gets done. For financial institutions, this means rethinking their approach to everything from data management to customer engagement.

Automating Repetitive Tasks

Why Automation Matters

Imagine a loan application process that requires hours of manual data entry or a debt collection system bogged down by repetitive emails and follow-ups. These inefficiencies waste time and money. Automation changes the game by:

- Reducing Manual Effort: Automating repetitive tasks allows teams to focus on strategy.

- Speeding Up Processes: Automation accelerates workflows, boosting customer satisfaction.

- Enhancing Data Accuracy: Consistency across automated processes ensures fewer errors.

The Power of RPA in Finance

Robotic Process Automation (RPA) acts as the backbone of many automated systems. It mimics human actions like entering data, sending emails, or processing transactions, but with precision and speed no human could match.

Take debt collection, for example. Using Power Automate, financial institutions can trigger automated workflows for sending payment reminders, updating account statuses, and generating custom reports.

Leveraging Artificial Intelligence

AI as the Financial Sector’s Secret Weapon

AI is the engine that drives smarter decisions in finance. By analysing vast datasets in real time, AI uncovers trends, predicts risks, and personalises customer interactions. Here’s how it’s making an impact:

- Predictive Risk Analysis: AI flags potential red flags before they escalate, allowing for proactive risk management.

- Customer Sentiment Tracking: Sentiment analysis tools gauge customer satisfaction, enabling institutions to address concerns early.

How AI Enhances Customer Experiences

AI isn’t just behind the scenes; it’s front and centre in reshaping customer interactions. Virtual assistants and AI chatbots handle thousands of queries simultaneously, offering 24/7 support without long wait times.

Financial institutions using tools like Dynamics 365 leverage AI to recommend tailored solutions based on customer preferences, boosting both engagement and loyalty.

Integrating Power Automate for Operational Efficiency

Streamlining Workflows

With Microsoft Power Automate, organisations can create workflows that bridge gaps between multiple systems, ensuring data flows seamlessly. From managing approvals to automating payment reminders, the platform simplifies and accelerates critical processes.

Real-Life Transformation

A global financial services firm modernised its customer service operations using Power Automate, saving countless hours of manual work while improving compliance and customer satisfaction.

Scaling Automation with Hyperautomation

Expanding Beyond Repetitive Tasks

Hyperautomation isn’t just about eliminating mundane processes, it’s about creating a smarter, interconnected system that continuously evolves. For financial services, this means linking tools like Power Automate, AI, and advanced analytics to enable end-to-end process transformation.

One example is process mining, where organisations analyse workflows to identify inefficiencies and automation opportunities. By combining this with tools like Robotic Process Automation (RPA), financial institutions can scale automation across departments, from customer service to back-office operations.

From Reactive to Proactive

Hyperautomation allows institutions to shift from reactive to proactive strategies. With predictive analytics powered by AI, businesses can anticipate customer needs, detect fraud early, and even predict regulatory changes that may affect operations.

Enhancing Data Management and Security

Handling Financial Data with Precision

Managing financial data securely is a cornerstone of the industry, but manual systems often fall short in accuracy and compliance. AI-driven data management changes this by ensuring that data entry, validation, and reporting are error-free and auditable.

Automation tools like Power BI integrate seamlessly into workflows, offering real-time dashboards that visualise performance metrics, identify trends, and support data-driven decisions.

Strengthening Cybersecurity

With hyperautomation, cybersecurity moves to the next level. AI-powered monitoring systems can detect anomalies in real time, preventing breaches before they occur. For financial institutions handling sensitive information, this level of protection is indispensable.

Creating Customer-Centric Experiences

Omnichannel Engagement

Today’s customers expect seamless, personalised interactions across every touchpoint. Hyperautomation enables omnichannel communication strategies, integrating email, SMS, chatbots, and even voice assistants into a cohesive system.

For example, Copilot Studio allow institutions to deploy AI-driven chatbots that handle FAQs, guide customers through processes, and escalate complex queries to human agents when needed.

AI-Driven Personalisation

By analysing customer behaviour and preferences, AI insights deliver hyper-personalised experiences, from recommending products to tailoring repayment plans. This not only improves customer satisfaction but also boosts retention rates.

Addressing Challenges in Hyperautomation

Tackling Legacy Systems

One of the biggest hurdles for financial institutions is migrating from outdated systems. Hyperautomation platforms like Power Automate Desktop make this transition smoother by integrating with existing infrastructure while enabling modern workflows.

For instance, banks using legacy VB6 macros have successfully migrated to Power Automate, significantly improving both compliance and operational efficiency.

Navigating Change Management

Implementing hyperautomation requires a cultural shift. Financial institutions must prioritise employee training and support to ensure the seamless adoption of automation tools. Workshops and user-friendly low-code platforms like Power Apps empower teams to adapt and innovate.

FAQs on Hyperautomation in Financial Services

Q. What is the difference between automation and hyperautomation?

Automation focuses on individual tasks, while hyperautomation orchestrates multiple technologies to automate end-to-end processes across the organisation.

Q. How does hyperautomation improve compliance?

By standardising processes and ensuring data accuracy, hyperautomation helps institutions meet regulatory requirements with less manual oversight.

Q. Is hyperautomation suitable for small financial institutions?

Yes, hyperautomation can be scaled to suit organisations of any size, offering cost-effective solutions like low-code platforms to streamline operations.

Q. How do I get started with hyperautomation?

Start by identifying high-impact processes that could benefit most by being automated. Tools like Power Automate and AI insights can then be used to design and implement workflows tailored to your needs.